By Moniba Ali

(Pak Destiny) The the Securities and Exchange Commission of Pakistan (SECP) has expedited probe into alleged manipulation of share prices of Bank of Punjab (BoP) through underwriting and insider trading – a Rs34bn scam – after the Senate Committee on Finance, Revenue and Economic Affairs has given a two-month deadline (December 31) to it.

“On the request of the SECP we have given two more months to complete a fair probe into this scam involving thousands of affected small shareholders,” Senator Kamil Ali Agha who is active member of the committee.

Talking to Pak Destiny Mr Agha said the committee wants SECP to fix responsibility on those involved in this mega share manipulation scandal of the country’s history. “It is a clear inside trading case and those involved in this crime should not be got away,” the senator said.

Sources said the matter was also brought to the knowledge of Punjab Chief Minister Shahbaz Sharif but he preferred no to raise the matter with the authorities concerned and did not seek report from the top officials of the bank in question.

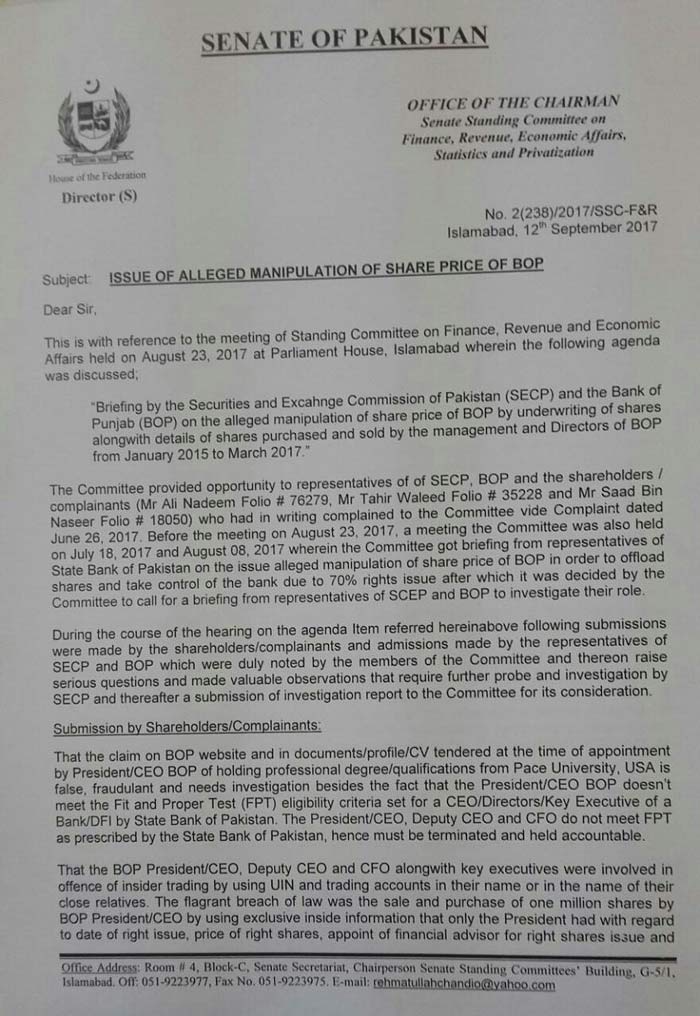

Recently the SECP and BoP gave briefing to the Senate Committee on the alleged manipulation of share price of BOP by underwriting of shares along with details of shares purchased and sold by the management and directors of BOP from Jan 2015 to March 2017.

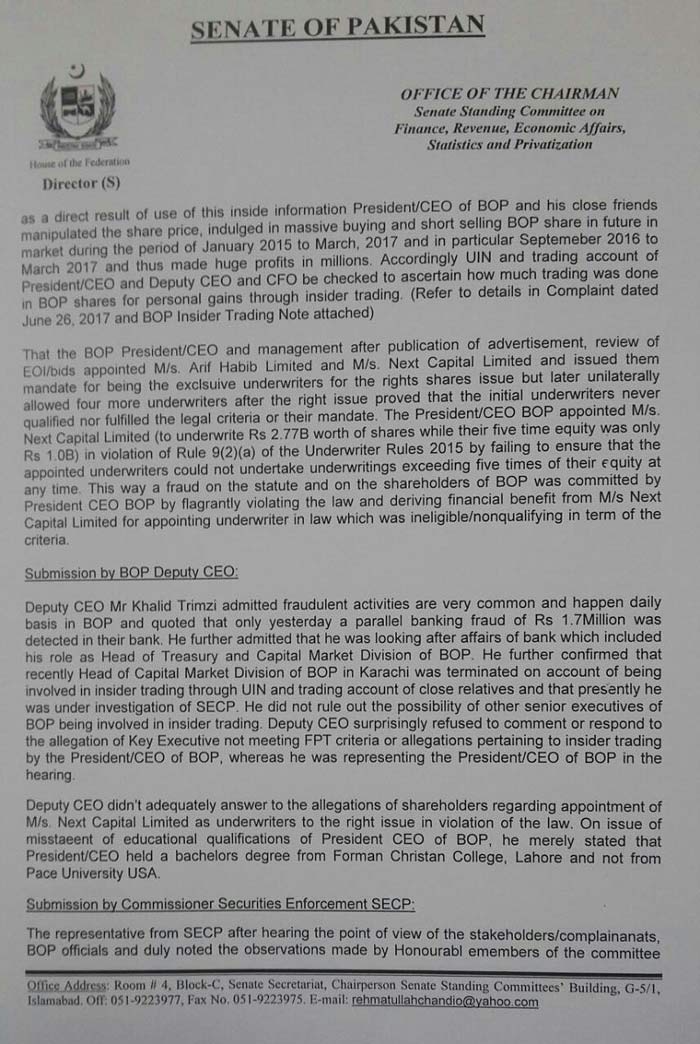

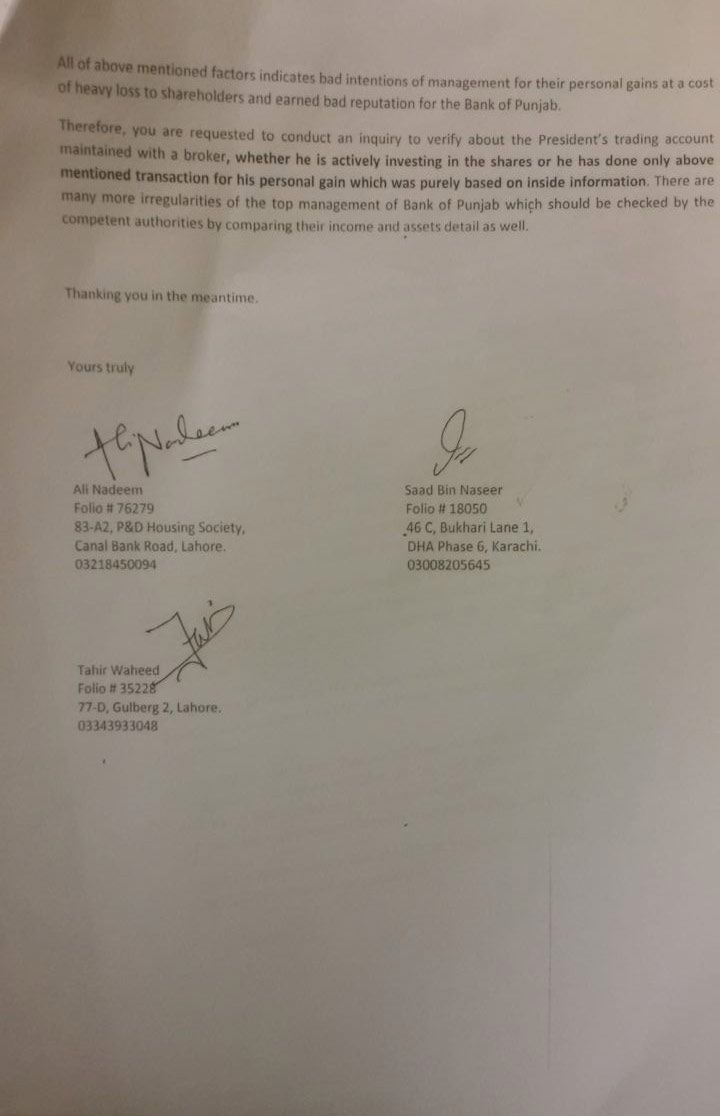

Some shareholders -Ali Nadeem, Tahir Waleed and Saad bin Naseer – filed their complaint before the committee. The complaint said: “The BoP Present/CEO – Naeemuddin Khan – who has a fake degree too, Deputy CEO and CFO alongwith key executives were involved in offence of insider trading by using UIN and trading accounts in their name or in the name of their close relatives. According to the law the sale and purchase of one million shares by BOP President/CEO by using executive insider information that only the president had with regard to date of right issue, price of right shares, appointment of a financial adviser for right shares issue and as a direct result of use of this inside information president of BOP and his close friends manipulated the share price, indulged in massive buying and short selling BOP Share in

future in market during the period of Jan 2015 to March 2017 and in particular September 2016 to March 2017 and thus made huge profits in millions.”

It said accordingly UIN and trading account of the president and Deputy CEO and CFO be checked to ascertain how much trading was done on BOP shares for personal gains through insider trading.

According to the minutes of the meeting, BOP Deputy CEO Khalid Trimzi admitted before the committee that fraudulent activities were very common and happen daily basis. He further admitted that he was looking after affairs of bank which included his role as head of treasurer and capital market division of BoP. He confirmed that recently head of capital market division of BoP in Karachi was terminated on account of being involved in insider trading through UIN and trading account of close relatives and that presently he was under investigation of SECP.

He did not rule out the possibility of other senior executives of BoP being involved in insider trading. “The Deputy CEO did not adequately answer to the allegations of shareholders regarding appointment of M/s. Next Capital Limited as underwriters to the right issue in violation of the law.”

PPP senior leader and Supreme Court Advocate Haider Zaman Qureshi that the shareholders’ representation to Punjab Chief Minister Shahbaz Sharif was ignored. “A loss of Rs34bn has been caused to the exchequer. The price of BoP share was Rs19 in March 2017 but after insider trading it today is trading at Rs8. The number of affected minority shareholders is 25,000,” he said.

Mr Haider demanded that the Federal Investigation Agency or National Accountability Bureau probe this mega scam.”

A senator who is partner of a law firm associated with BoP attended the committee’s meeting which her colleagues seen as conflict of interest.

“Senator Ayesha Raza Farooq is a partner of Ramday Law Associates being paid lawyer of BoP attended last hearing of the Senate committee. How come she can sit in its meetings… isn’t it conflict of interest,” an official questioned. – Pak Destiny

sab milay huay hain

whoever have don this manipulation of shares must be a genius. he opted the different route of corruption unkown to others

This type of corruption can’t be done without govt support. A thorough investigation or JIT must be formed to probe this scam

corruption everywhre