Thousands of Mossack Fonseca (MF) documents reviewed by The Indian Express and subsequent enquiries reveal that the Sharif family mortgaged four of these properties to the Deutsche Bank (Suisse) SA for a loan of GBP 7 million and the Bank of Scotland part financed the purchase of two other apartments.

While the Pakistani media had connected some of these BVI companies and London properties to the Sharif family in the past, Nawaz Sharif has denied ownership of any such property. Hussain and Hasan Nawaz Sharif, and Mariam Safdar, did not respond to queries emailed to them by The Indian Express.

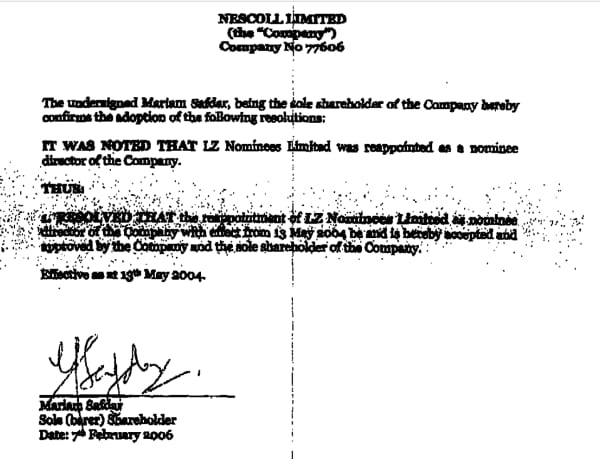

Nescol Limited and Nielson Holdings Limited were incorporated in BVI in 1993 and 1994, respectively, and were held by one bearer share each. In February 2006, Mariam Safdar signed a resolution of Nescol Limited as the “sole (bearer) shareholder”. MF was appointed as the registered agent through Minerva Trust which described Mariam Safdar as the beneficial owner of both companies.

In August 2008, BVI law firm Farara Kerins issued two legal opinions. As Nescol’s property, it identified “leasehold properties known as 17… and 17A Avenfield House, 117 to 128 Park Lane, London, W1K 7AH and car parking space 9 and box room 6… registered… with Title Numbers NGL342976 and NGL342977 respectively”. As Nielson’s property, it identified two titles of 16 and 16A Avenfield House.

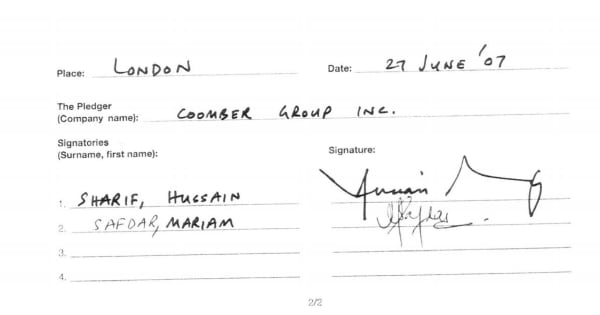

In October 2008, Deutsche Bank (Suisse) SA sanctioned a “cross collateralised”loan of up to GBP 7 million —GBP 3.5 million to Coomber Group Inc (BVI) and GBP 1.75 million each to Nescol and Nielson —against the four Avenfield House titles. Earlier, in June 2007, Sharif’s elder son Hussain and daughter Mariam signed the mortgage agreement for Coomber Group Inc.

Following queries from the Financial Investigation Agency in 2012, MF invoked the Anti-Money Laundering and Terrorist Financing Code of Practice (2008) to grill Minerva for information about Nescol and Nielson. In June 2012, Minerva Trust & Corporate Services Ltd revealed that both companies “owned a UK proper each” —16 and 17 Avenfield House —and were “owned by the same beneficial owner Mariam Safdar”.

Adding that the companies had a loan account with Deutsche Bank Geneva, Minerva said that “neither property is rented and only occupied by the owner and her family.” MF passed on the details to FIA. But assured by Minerva that they were aware of the client’s Politically Exposed Person (PEP) status, MF ordered compliance monitoring every six months and decided not to provide nominee (proxy) directors or shareholders for Mariam’s companies.

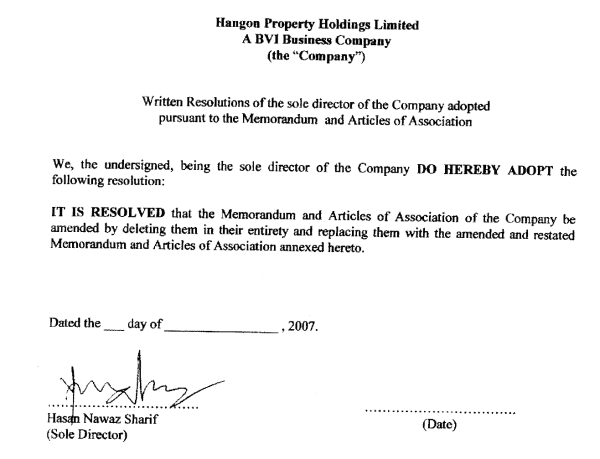

Hasan, Nawaz Sharif’s younger son, also owned at least one company in BVI. Hangon Properties Holding Limited was incorporated in BVI in February 2007 with an authorised capital of US$ 50,000.

In June 2007, 10 shares were issued to Cascon Holdings Establishment Limited (Liberia). The next month, the shares were transferred to Hasan Nawaz Sharif for GBP 5.5 million and the Bank of Scotland sanctioned a mortgage loan of unknown amount to Hangon “to assist in the purchase of the property (Flat Nos 3 and 4 ) at 1 Hyde Park Place, London.”

In August 2007, MF was told that Hasan had purchased the issued share capital in Hangon from Cascon Holdings (Liberia). Asked to take a call by MF’s compliance department in October 2007, Jurgen Mossack wrote: “Si, correcto. NO aceptar el cliente en forma directa, por mi parte (Yes, correct. As far as I’m concerned, DON’T accept the client directly) –Pak Destiny

[…] (Pakdestiny.com) PML-N government is making a last ditch effort to stop Imran Khan of PTI from giving a sit-in outside the Raiwind residence of Prime Minister Nawaz Sharif. […]